tax strategies for high income earners australia

The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over 180000 is 45 in 202122. Because she stays at home she only has to pay 13500 in taxes.

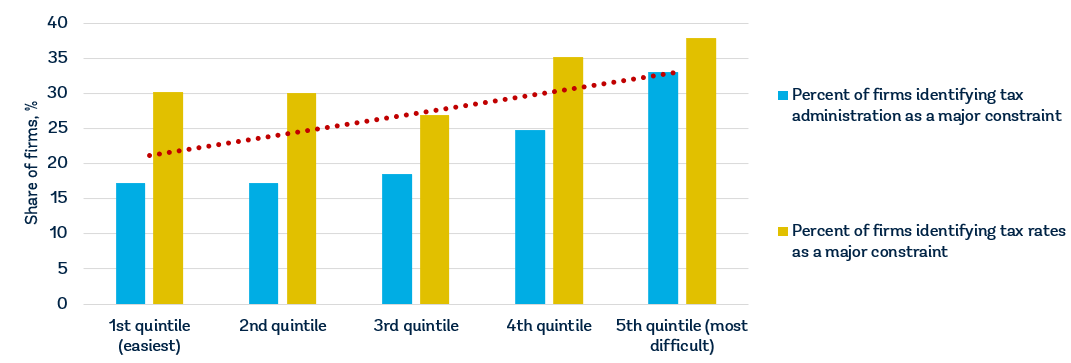

Current Challenges In Revenue Mobilization Improving Tax Compliance In Policy Papers Volume 2015 Issue 005 2015

Additionally tax-deferred accounts benefit by compounding.

. According to Australian Bureau of Statistics data the average Australian now earns 62400 a year. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. A tax offset of 10000 would reduce your tax payable down to 16000.

Most common is to start a business consulting to other similar businesses who need their skill knowledge or service. If you have 100000 of assessable income for the year your tax payable would be approximately 26000. 50 Best Ways to Reduce Taxes for High Income Earners.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Whether you want to minimise the tax youre obligated to pay are interested in setting up an SMSF or just want to ensure youll be able to maintain your current lifestyle in retirement were here to help. Using a Discretionary Trust to reduce taxes.

Based on new survey data an individual earning 1200 a week or more will have a higher income than the bottom half of Australians. Knowing the right tax reduction strategies for high-income earners is key to lowering your income taxes. The contribution you will make.

However provided your personal marginal tax rate is greater than 15 youre ahead. She also has a partner who earns a salary of 180000 pa. Find out how to lower your tax bill for 2020.

Lower income earners will actually receive a refund of contributions tax. Republic Of Armenia In Imf Staff Country Reports Volume 2019 Issue 031 2019 August 12 2014. Dont waste your good fortune or hard work by not assessing if you are using the system to your advantage.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The ESIC concessions allow an investor to claim a 20 tax offset on the amount they have invested in an early stage investment company.

The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000. Below we outline the top 10 tax planning strategies for high income earners and highlight how you can make the most of your tax planning strategy. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice.

That means that if you earn more than 170050 in. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. If you would like a second opinion or Free review as to how we.

For those trying to learn how to save tax in Australia salary sacrificing is one way to do it. Tax reduction strategies for high income earners australia Tuesday March 1 2022 Edit. With salary sacrificing a taxpayer would put some of their pre-tax income toward a benefit before they are taxed.

This rate is lower than the personal income tax rate. High Income Earners Youre earning a higher-than-average wage but need assistance to help you identify and reach your goals. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

Overview of Tax Rules for High-Income Earners. Actual high salary earners have limited options really. There are four commonly used business structures in Australia.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. For taxable income levels between 180000 and 273000 the tax saving will be 34. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates.

50 best ways to reduce taxes for high income earners 1. This is also called salary packaging and it works a few different ways. When you make a concessional contribution into your super account however you only pay a 15 tax rate.

The other way high income earners reduce tax in Australia is by having a savvy and switched on accountant who specialises in this area. So the money was distributed to Mary. For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19.

Both are studying and will continue education for another 5 years. Here are some of our favorite income tax reduction strategies for high earners. Individuals who are passionate about giving back to their community or particular causes should consider making a tax deductible donation to an Australian Deductible Gift Recipient DGR.

Review your business structure. Sole trader partnership company and trust. Lets start with an overview of tax rules for high-income earners.

In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. At Imagine Accounting we work with a number of high income earners to help them legally minimise their tax bill and make the most of their income.

In this case they could distribute the trusts profits to trustees while remaining under the tax-free threshold thereby creating wealth by decreasing. Unless you are a high-income earner whereby you will pay up to 30. Tax planning through tax minimization strategies is ultimately beneficial to high-income earners when done under the guidance of tax accountants and CPA accountants.

Business owners need to understand the responsibilities of each structure since each structure affects the tax theyre liable to pay asset protection and ongoing costs. Most of our sydney clients are in the top 15 of earners in australia. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner.

Come in for a review at no cost and see what possible. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Change the way you get paid. The maximum amount that can be contributed to superannuation as a concessional contribution is 25000 per financial. Tax reduction strategies for high-income earners in australia The higher your tax bracket the higher the benefits are of tax savings.

Australias high-income earners can invest in family trusts. While you can minimize your tax you shall have more money at hand for building your individual wealth. A family trust or a discretionary trust can be a means for them to build wealth if they apply tax-effective financial strategies.

The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. So Call us on 0280625961 or Book an Appointment.

You will be able to avoid penalties for tax evasion.

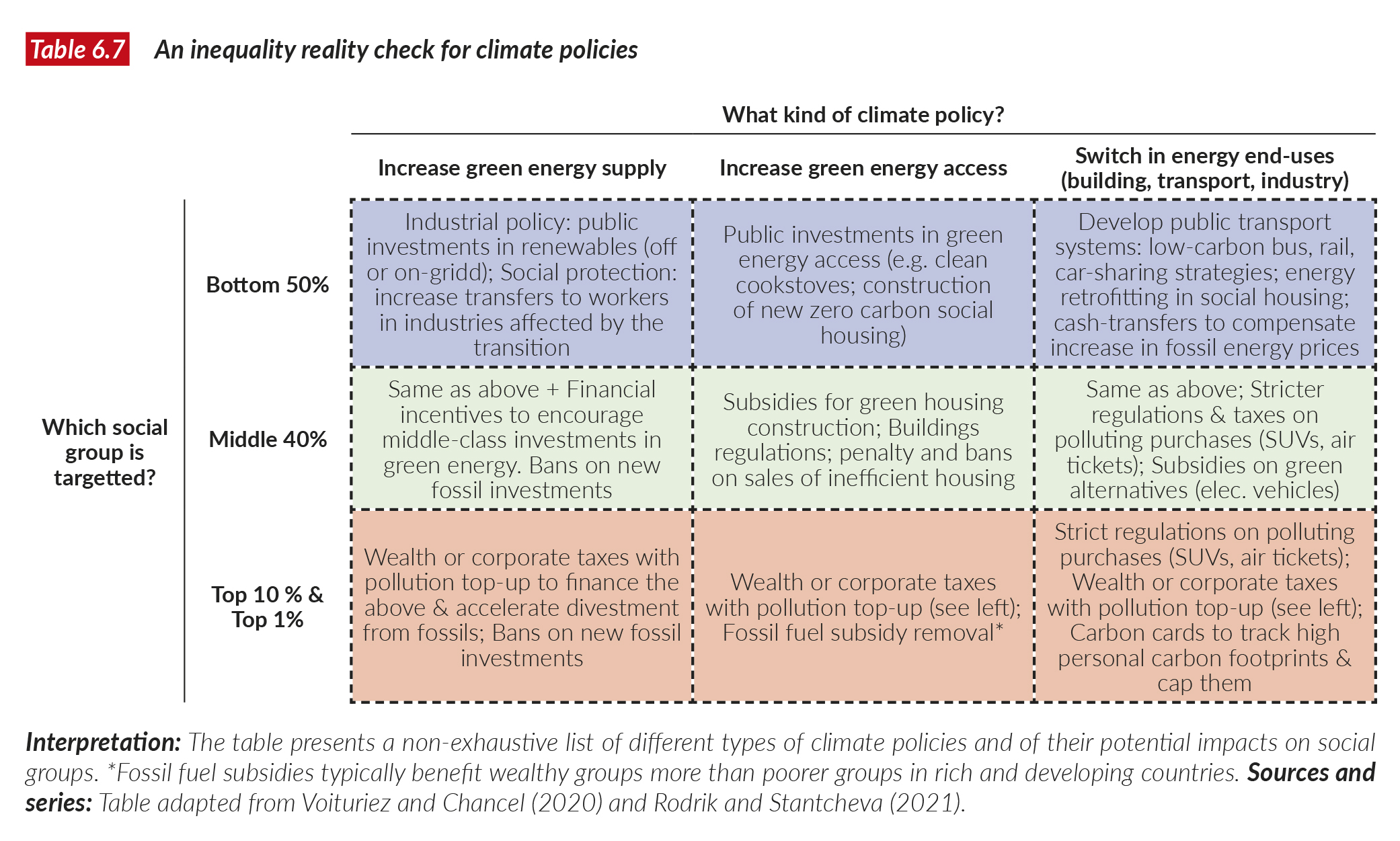

The World Inequalityreport 2022 Presents The Most Up To Date Complete Data On Inequality Worldwide Global Wealth Ecological Inequality Income Inequality Since 1820 Gender Inequality

Worried About Taxes Going Up 9 Ways To Reduce Tax

In July 2017 The Australian Governments Changes To Super Meant That Transfers From Super To Pensions Are Now Capped At 1 6m Concessional And Non Concessional Annual Contributions Limits Also Decreas Generation Life

Roth Ira Strategies For High Income Earners Bkd

The Australian Tax Planning Playbook Volume 1

Tax Planning Advice In Melbourne

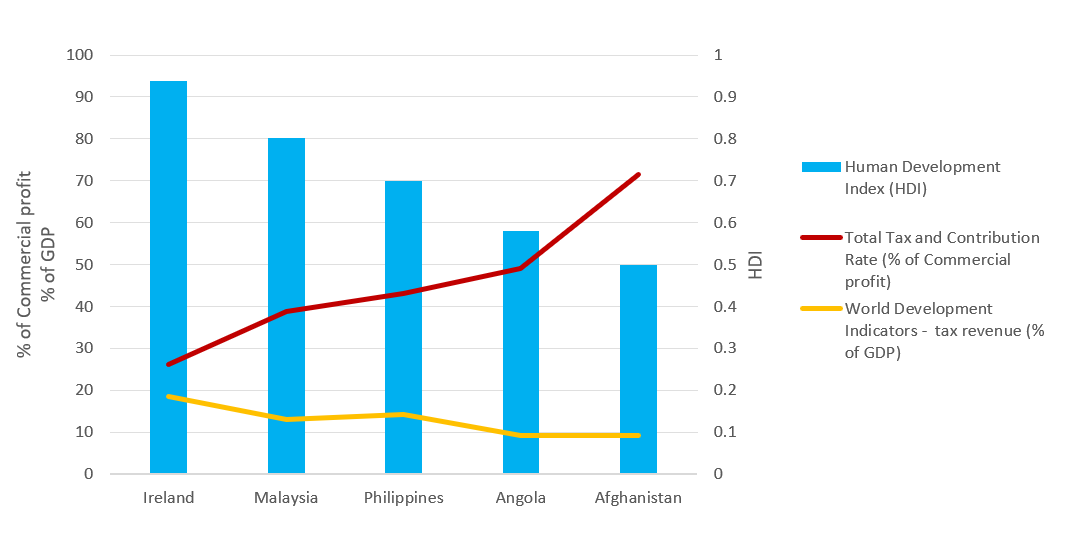

Why It Matters In Paying Taxes Doing Business World Bank Group

Guide To The Low Income Tax Offset Lito

Why It Matters In Paying Taxes Doing Business World Bank Group

Proposed Tax Changes For High Income Individuals Ey Us

Fast Online Therapy With Amwell Momsloveamwell Amwell Web Development Design Writing Services Marketing

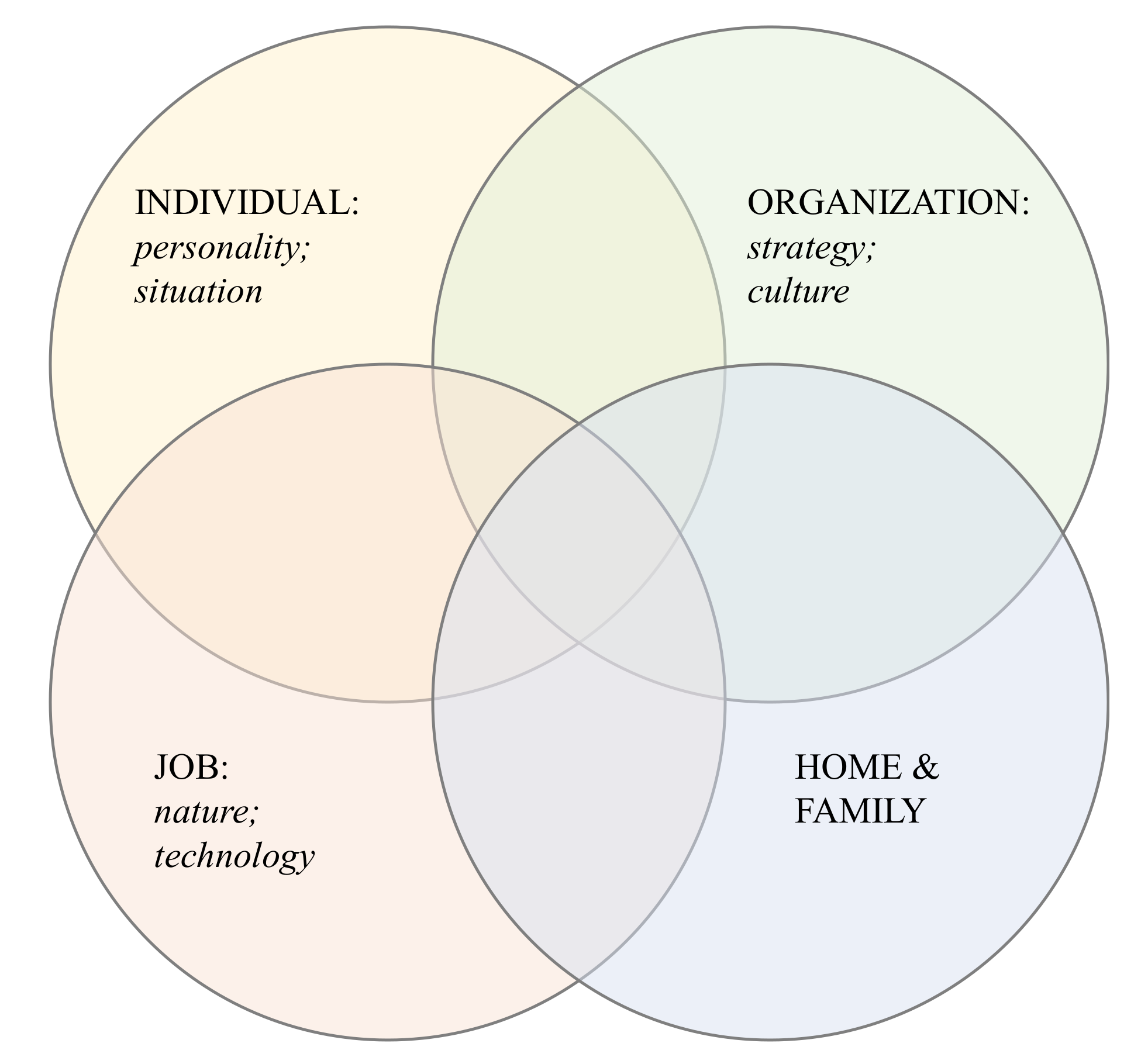

Sustainability Free Full Text The Breath Of The Metropolis Smart Working And New Urban Geographies Html

Current Challenges In Revenue Mobilization Improving Tax Compliance In Policy Papers Volume 2015 Issue 005 2015

3 Raising Adults And Enterprises Participation In Learning In Lithuania Oecd Skills Strategy Lithuania Assessment And Recommendations Oecd Ilibrary

Bangladesh Poverty Reduction Strategy Paper In Imf Staff Country Reports Volume 2013 Issue 063 2013

Bangladesh Poverty Reduction Strategy Paper In Imf Staff Country Reports Volume 2013 Issue 063 2013

Tax Planning Tips To Minimize Your 3 8 Medicare Surtax

The 100 000 Tax Deduction Most High Income Business Owners Miss